How to Remain Compliant When Dealing with High-Risk Countries in Business Central

1. Identify High-Risk Countries

Start by identifying countries that are considered high-risk. These countries have strategic deficiencies in their anti-money laundering and counter-terrorism financing regimes.

Refer to the list of high-risk countries established by the European Commission.

2. Increased Vigilance

As a Business Central user, you must exercise increased vigilance when dealing with transactions and relationships involving high-risk countries.

Implement additional checks and measures as required by the Anti-Money Laundering Directive (AMLD).

3. Aptean Advanced Workflow

Use Aptean Advanced Workflow to automate and guide your processes.

Design workflows that are specifically tailored to the requirements for high-risk countries.

Consider approval workflows, data validation, and risk-based approaches.

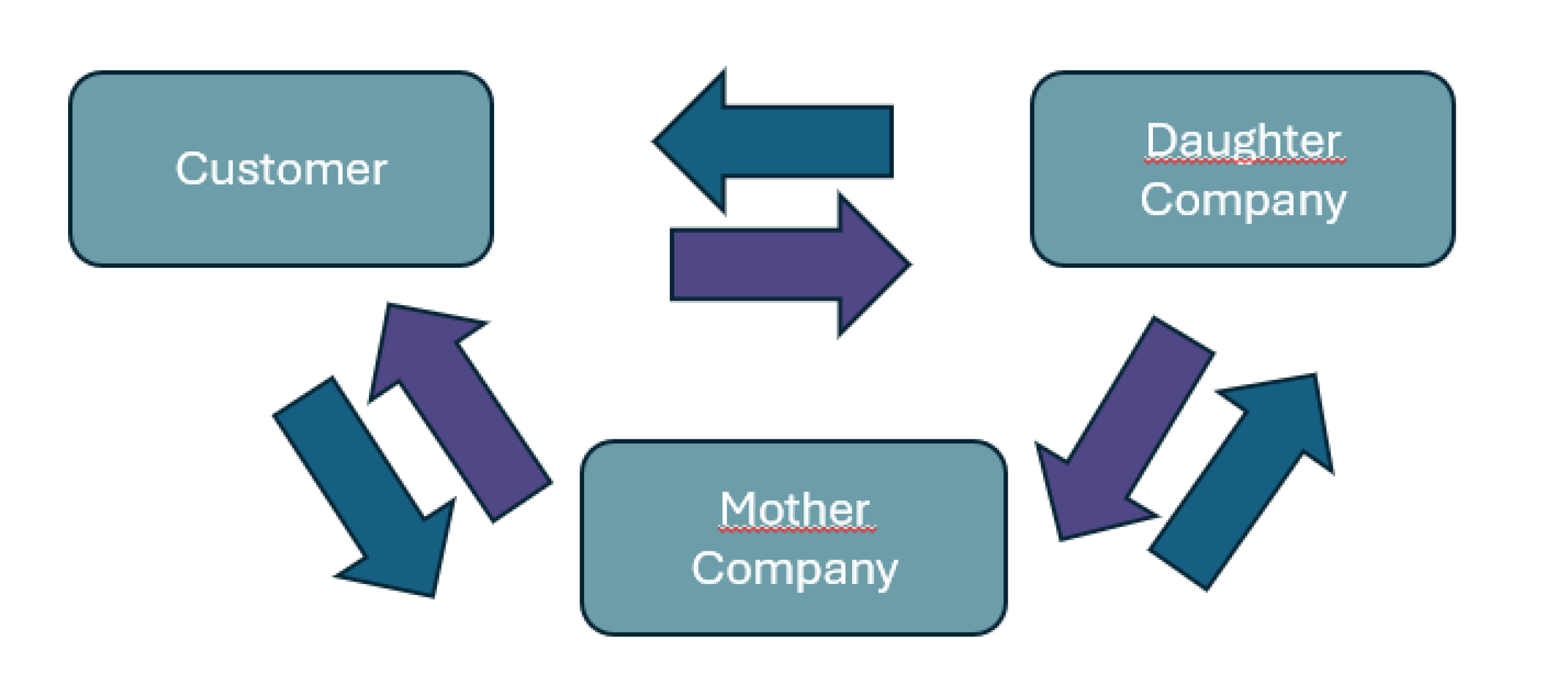

4. Integration with Business Central

Ensure that as many processes as possible are automated. Integrate Business Central via the Power Platform with external data sources to enable automated processing, even with external data.

5. Maintenance and Monitoring

Stay informed about updates and changes regarding high-risk countries.

Adjust your workflows based on new information and requirements.

By following this approach, you can remain compliant with EU regulations as a Business Central user, even when dealing with transactions involving high-risk countries.

If you need more specific information, feel free to reach out!